Battery breakthroughs vs incremental progress

A recent post I saw on LinkedIn discussed academic battery research that’s overhyped by the media. I’m occasionally asked about my thoughts on “battery breakthrough press release X”, and this article comes close to my perspective.

Overall, I share the author’s view on “breakthrough” technologies. In a mature (25-year), successful ~$30 billion dollar industry like this one, challengers to incumbents like Samsung and Panasonic are competing with commodities—a bad idea, according to Microeconomics 101. The battery field is especially prone to gimmicky “breakthroughs” that can’t approach lithium-ion technology on energy density or cycle life, let alone cost.

(There are certainly exceptions—I’m biased, but I’m excited by my labmates’ work on an (unpublished) liquid-metal battery that is technically and economically solid.)

This point has been discussed many times before, so I’ll just point to other sources here. This Scientific American article talks about the fallacy of applying Moore’s law to batteries:

The basic reasons why an emerging technology may not follow Moore’s Law is either because we tend to underestimate the complexity of the system to which the technology is applied, or we underestimate the basic principles of physics and chemistry which would inherently constrain a Moore-type breakthrough in that field.

This MIT Technology Review article has a terrible clickbait-y title, but gets the point across well:

Meanwhile, the Big Three battery producers, Samsung, LG, and Panasonic, are less interested in new chemistries and radical departures in battery technology than they are in gradual improvements to their existing products. And innovative battery startups face one major problem they don’t like to mention: lithium-ion batteries, first developed in the late 1970s, keep getting better.

However, some non-Li-ion battery companies have proven to be the exception—Primus Power, in particular, has multiple installations in the US and abroad. Primus has found success in the burgeoning grid storage market.

Optimism

In the original article, the author closes with a sentence I strongly disagree with:

There are lots of things in the tech world to be optimistic about. But batteries aren’t one of them. Sadly.

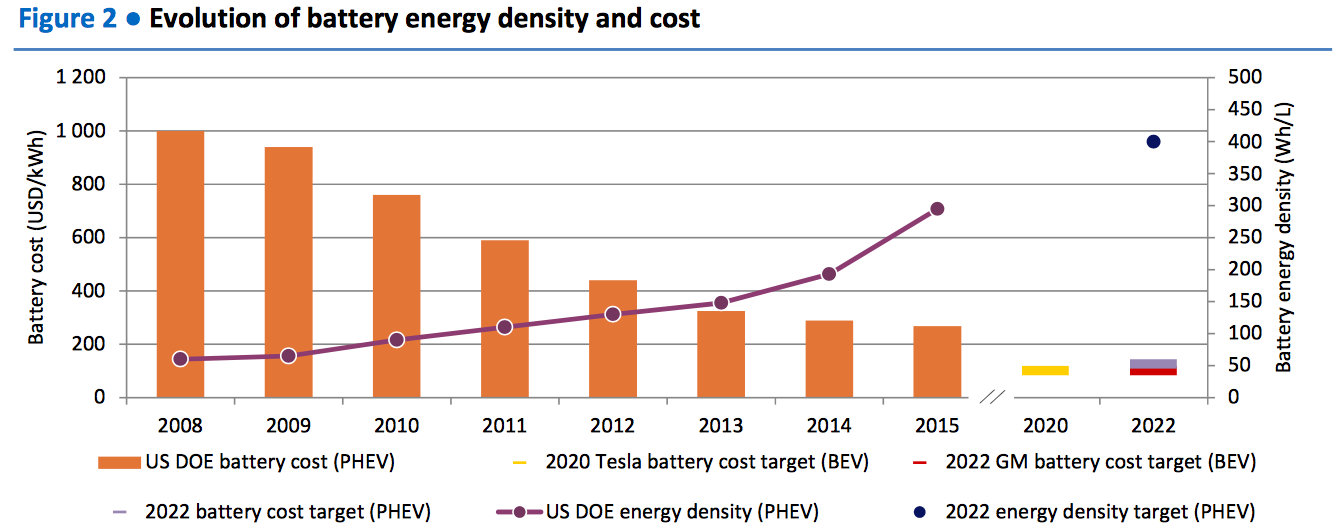

What’s not to be optimistic about? According to a recent IEA report, battery cost and energy density are both making gains of 5–8%/year:

That’s fantastic! I’d certaintly invest in a company with 5–8% annual returns. Plenty of exciting “incremental” developments, such as incorporating silicon into graphite anodes and using nickel-rich layered oxide cathodes, will continue to increase energy density. Additionally, we can improve performance, particularly cycle life, by optimizing how we use our batteries (the focus of one of my research projects). And certainly large-scale manufacturing innovations like the Gigafactory will continue to decrease costs via economies of scale.

Batteries have matured to the point that 300 mile electric vehicles are achievable. On a personal note, I don’t worry about my cell phone battery all day unless I forget to charge it at night. Lithium-ion battery technology is already excellent, has improved substantially in the past 25 years, and will continue to improve as interest in electrifying transportation increases.